We will seize the business opportunities offered by the global energy transition.

Boralex offers growth, dividend returns and long-term value creation

- Unique positioning and acknowledged expertise

- Company growth

- Well-defined strategic plan and financial objectives in an industry with robust potential

- Disciplined financial management and strong financial position

Our strength lies in the expertise, skills and ingenuity of our employees. We’re committed to carrying out our strategic plan:

- By acting ethically

- By being a model corporate citizen

- By giving back to communities

- By offering sustained financial performance to shareholders and partners

Unique positioning and acknowledged expertise

- 3,133 MW of highly diversified production capacity as of August 14, 2024.

- Expertise in developing small and mid-sized projects

- As at June 30, 2024, 91% (1) of Boralex’s installed capacity was covered by fixed-price and indexed energy sales contracts or feed-in premium contracts in effect. Over the past few years, Boralex has been able to diversify its customer base by signing corporate PPAs with major companies in Europe.

- The weighted average remaining term (2) of these contracts is 11 years (12 years in North America and 10 years in Europe). The breakdown of the remaining terms of the Corporation’s contracts are provided in the table below.

(1) The percentage of installed capacity covered by energy sales contracts or feed-in premium contracts is a supplementary financial measure. For more details, refer to the Non-IFRS and other financial measures section of the 2024 Interim Report 2.

(2) The average remaining term includes feed-in premium contracts that are not yet in effect for newly commissioned facilities.

Company Growth

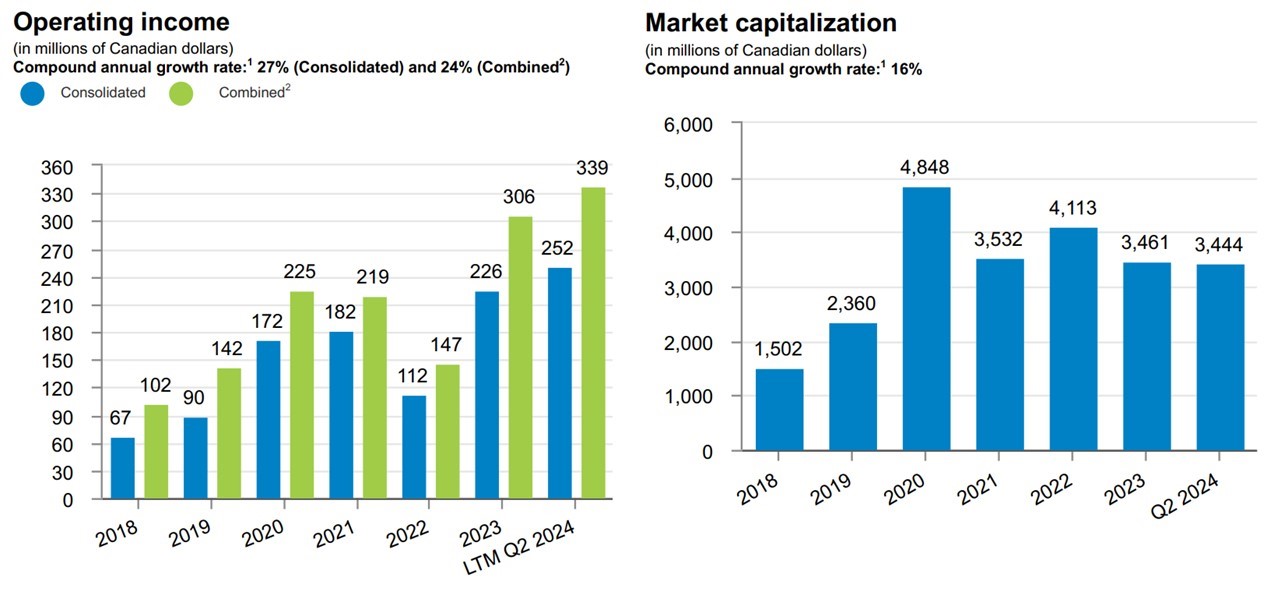

- Since December 31, 2018, Boralex’s share price and market capitalization have increased at compound annual growth rates(1) of 13% and of 16%, respectively.

- Boralex’s operating income was up 27% (24% increase on a Combined(2) basis).

- For EBITDA(A), the compound annual growth rate is 14% (14% on a Combined basis).

(1) Compound annual growth rate is a supplementary financial measure. For more details, refer to the Non-IFRS and other financial measures section of the 2024 Interim Report 2.

(2) Combined basis is a non-GAAP financial measure and does not have a standardized meaning under IFRS. Accordingly, it may not be comparable to similarly named measures used by other companies. For more details, see the Non-IFRS and other financial measures section in the 2024 Interim Report 2.

Well-defined strategic plan and corporate objectives in an industry with robust potential

- 4 strategic orientations: growth, diversification, customer base and optimization

- 6 corporate objectives

- 10 ESG priority issues

- Project portfolio of 6.8 GW of wind, solar and storage projects.

Disciplined financial management and strong financial position

- Major cash flows from long-term contracts

- Strong balance sheet and the financial flexibility to support growth

- Limited exposure to interest rate fluctuations with fixed long-term rates timed to contract maturity

- Exchange rates hedged with forward contracts for France

Invest in a company with a solid ESG strategy

The markets are clear: the carbon footprint of a portfolio is increasingly important to investors. That’s why we have built a corporate social responsibility (CSR) strategy based on transparency and strong governance, and why our approach is based on the priorities of our internal and external stakeholders, including our investors and financial analysts.

ESG: Our actions, our commitments and our approach

Our growth strategy is tied directly to our Environmental, Social and Governance actions. In fact, we have raised our CSR objectives to the same level as our financial objectives in our updated Strategic Plan for 2025.

Investing in Boralex means participating in the growth of a renewable energy company that goes far beyond its industry in terms of sustainable development.

Our progress in CSR of the 2nd quarter of 2024

Financial analysts

Financial coverage of Boralex

- National Bank - Ruper Merer

- BMO - Ben Pham

- CIBC - Mark Jarvi

- Cormark - Nicholas Boychuk

- Desjardins - Brent Stadler

- Peters & Co - Ken Chmela

- Raymond James - David Quezeda

- RBC - Nelson NG

- Scotiabank - Justin Strong

- TD - Sean Steuart

The above list is strictly informative. The opinions, estimates or forecasts provided by these analysts with respect to Boralex’s performance are their own and do not represent those of either Boralex or its management.