Growth Strategy

Strategic Plan and Corporate Objectives for 2025

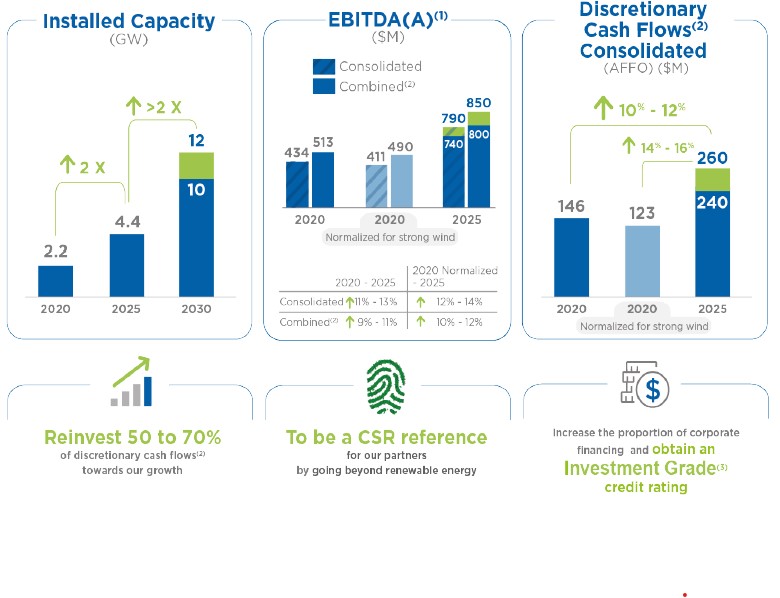

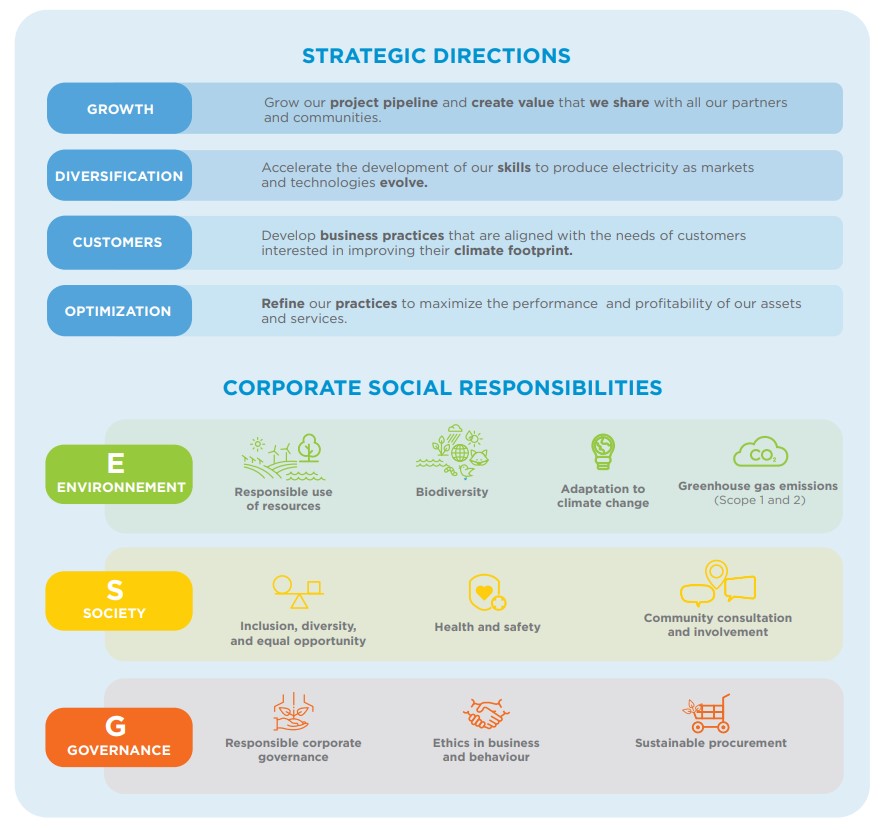

In June 2021, Boralex’s management announced its updated strategic plan. The Corporation builds on the four key strategic directions and its corporate social responsibility (CSR) strategy in order to achieve the six new corporate objectives by 2025. To successfully implement its plan, the Corporation relies on its solid expertise and long track record in project development.

Highlights of the Strategic Plan

- Significantly increase the share of solar power in the asset and project portfolio and make a breakthrough in storage

- Position the United States as our primary market for development and diversify our geographic presence in Europe and other U.S. states

- Accelerate the wind power development in Canada

- Optimize capital structure with a greater share of corporate financing, including sustainable financing

- Expand our existing customer base to directly supply electricity consuming industries interested in improving their climate and societal footprint

- Integrate our corporate social responsibility (CSR) strategy, including environmental, social and governance (ESG) priorities, into Boralex’s strategic directions

- Present 2025 corporate objectives including organic and inorganic growth

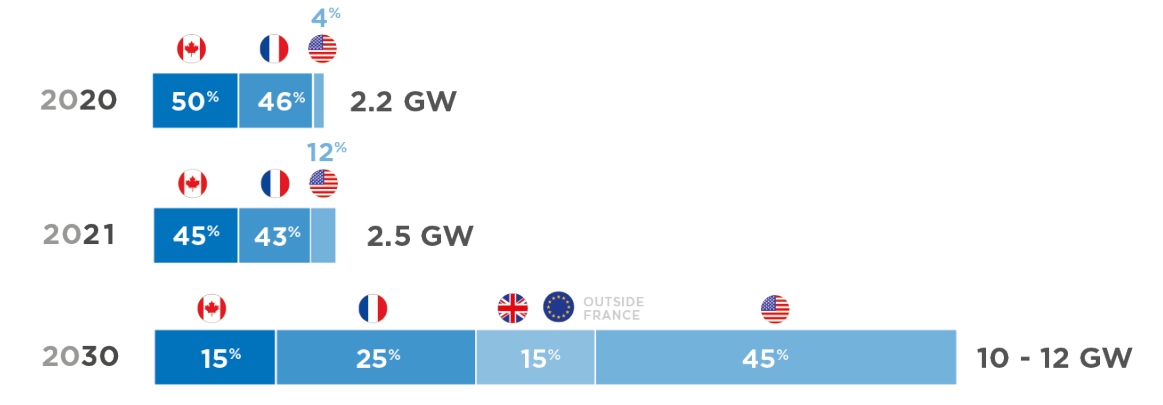

Targeted geographical breakdown of installed capacity (in GW)

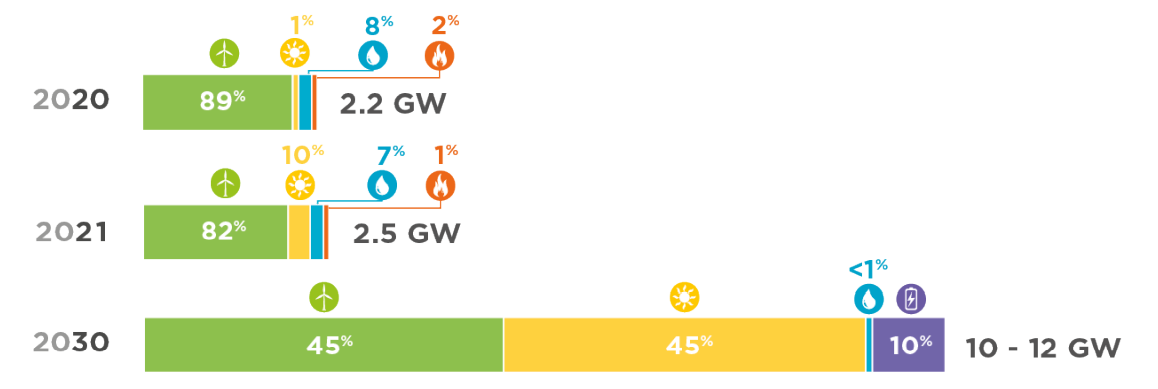

Targeted technological breakdown of installed capacity (in GW)

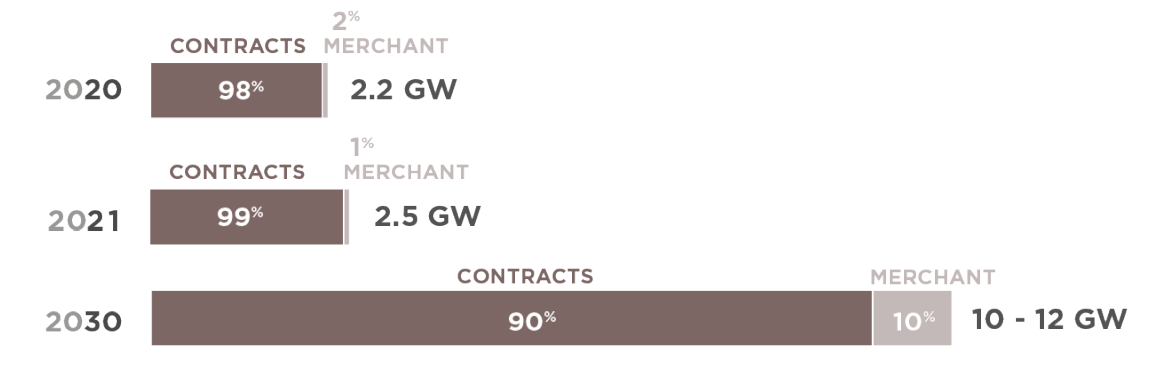

Targeted breakdown by contract type of installed capacity (in GW)

Corporate objectives for 2025

(1) EBITDA(A) is a total of segment measures. For more details, see the Non-IFRS and other financial measures section in the 2024 Interim Report 1.

(2) Combined basis and discretionary cash flows are non-GAAP measures and do not have a standardized meaning under IFRS. Accordingly, they may not be comparable to similarly named measures used by other companies. For more details, see the Non-IFRS and other financial measures section in the 2024 Interim Report 1.

(3) Minimum corporate credit rating of BBB-.

Our strategic directions at a glance

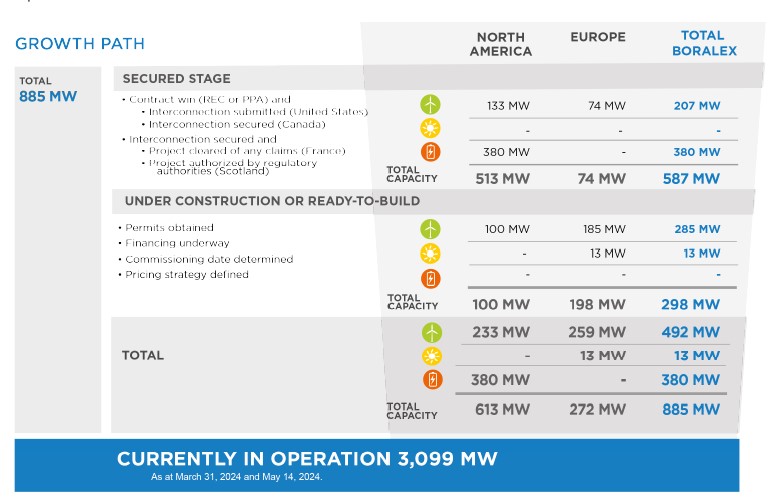

Growth Path

The Growth Path chart below shows the projects that have obtained all the authorizations required for launching construction:

Strategic directions

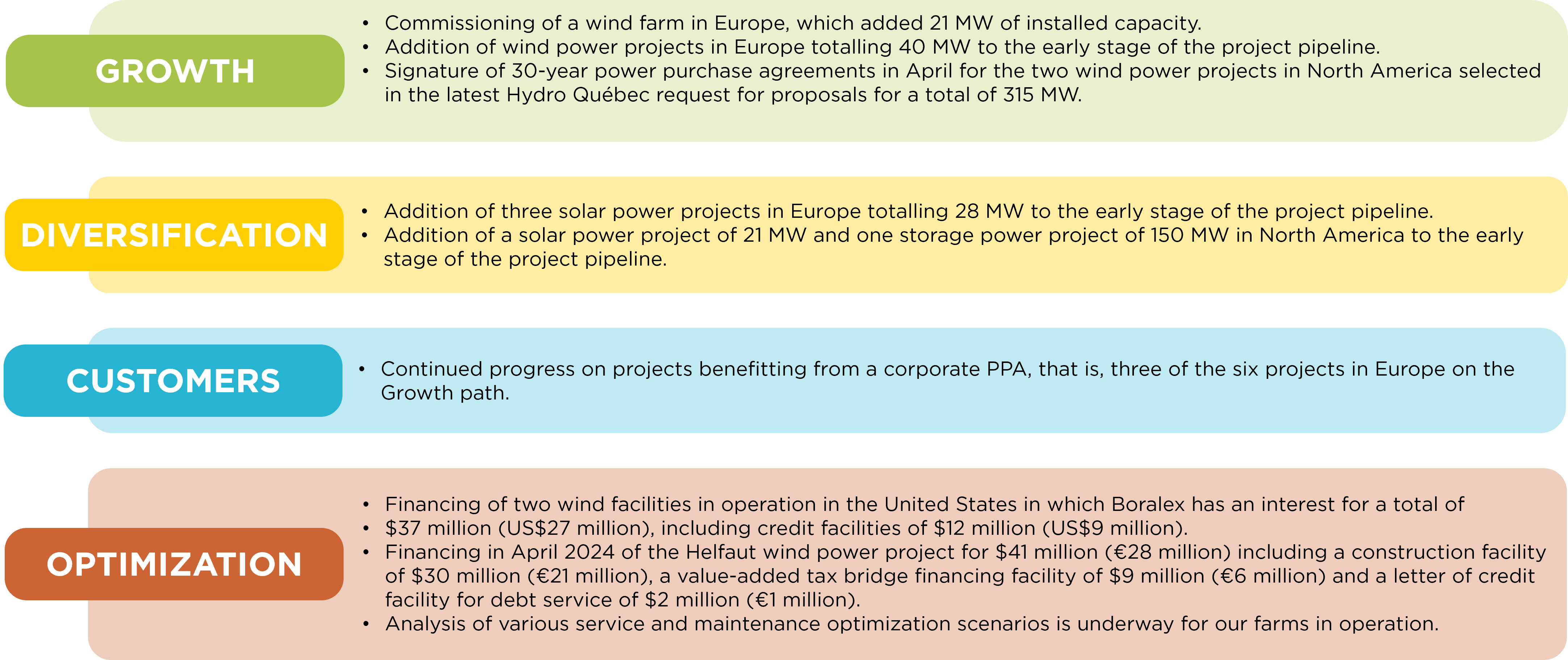

Our progress in our four strategic pillars during the first quarter of 2024.