Overview of Boralex

At Boralex, we have been providing affordable renewable energy accessible to everyone for over 30 years. As a leader in the Canadian market and France’s largest independent producer of onshore wind power, we also have facilities in the United States and development projects in the United Kingdom.

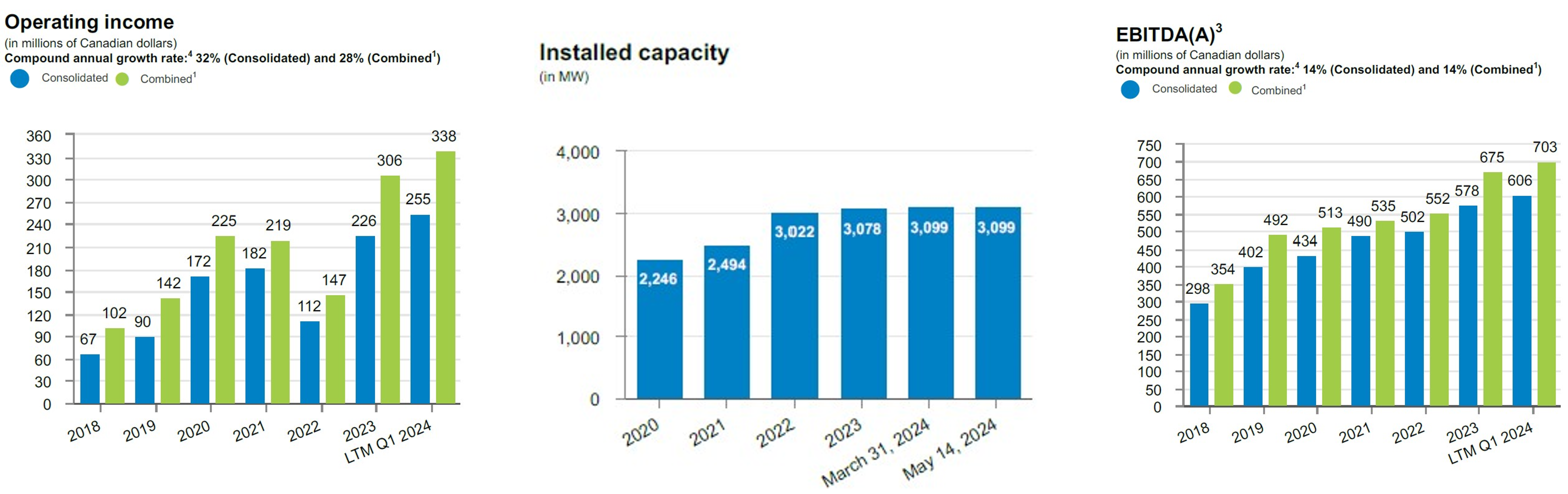

Our installed capacity has more than doubled over the past five years to over 3 GW. We are developing a portfolio of close to 6.7 GW in wind, solar and storage projects, guided by our values and our approach to corporate social responsibility (CSR).

Through profitable and sustainable growth, Boralex is actively participating in the fight against global warming. Thanks to our fearlessness, our discipline, our expertise and our diversity, we continue to be an industry leader.

Boralex’s shares are listed on the Toronto Stock Exchange under the ticker symbol BLX.

1st quarter highlights

(1) Combined, Cash Flow from operations and Discretionary Cash Flows are non-GAAP financial measures and do not have a standardized definition under IFRS. Therefore, these measures may not be comparable to similar measures used by other companies. For more details, see the Non-IFRS financial measures and other financial measures section of the 2024 Interim Report 1.

(2) Power production includes the production for which Boralex received financial compensation following power generation limitations imposed by its customers since management uses this measure to evaluate the Corporation’s performance. This adjustment facilitates the correlation between power production and revenues from energy sales and feed-in premium.

(3) EBITDA(A) is a total of sector measures. For more details, see the Non-IFRS financial measures and other financial measures section of the 2024 Interim Report 1 .

(4) Compound annual growth rate is a supplementary financial measure. For more details, refer to the Non-IFRS and other financial measures section of the 2024 Interim Report 1.

Growth Strategy

Boralex unveiled its updated strategic plan and corporate objectives for 2025. Discover the details of the strategy.

Why Invest?

Boralex offers long-term growth, dividend yield and long-term value creation, with corporate and social responsibility objectives raised to the same level as the financial objectives in its strategic plan.

ESG/CSR

Boralex’s corporate social responsibility (CSR) report was published in March 2024. Learn about our achievements in 2023 and our commitments for 2024 in terms of ESG (environment, society, governance).

Events & Presentations

Add our upcoming events to your calendar.

Executive Committee & Board of Directors

A team of committed, vigilant managers ensures Boralex’s success. Meet our Executive Committee and our Board of Directors.